A Financial Planner’s Advice About Saving For College: Just Do It.

More Floridians are saving in Florida 529 Savings Plans than ever before. In December 2017, there were just over 66,000 accounts; now, that number now is nearly 130,000 — almost double in the past five years! Why the increase?

We asked Mari Adam, a certified financial planner at Mercer Advisors in Boca Raton, to weigh in. Over her 31 years in the industry, she has talked to hundreds of Florida clients about saving for college. She said 529 savings plans are “a happy contagion,” with people spreading good news by word of mouth and opening accounts for each new grandchild. She also said that when Florida Prepaid repositioned its 529 Savings Plans to reduce fees and increase investment options three years ago, people took notice.

“It’s really now best in class,” she said. “We look out for a couple things when recommending a 529, and one of them is fees. This is one of the very lowest-cost plans out there. And they put in some really attractive investment options, with very appropriate age-based solutions and the option to choose your own investments. The simple solution is there; the sophisticated solution is there. Most do not offer that flexibility.” Parents who also buy a Florida Prepaid Plan — like she did for her two children — enjoy the bonus convenience of keeping all of their investments in one location.

Feeling inspired to open an account? Adam has several pieces of advice to help you get started and be successful.

Just do it. About half of all people are still saving for college using a savings account. “It’s good to save, but that is really not the optimal way, just because of the growth and tax advantages you’re missing out on,” Adam said. “529s are clearly the Rolls Royce of the saving-for-college world.”

“The mere act of opening a 529 account and saving for college means you will end up saving twice as much for college as someone who does not plan ahead. And end up with 47% less student debt. And your kids or grandkids are over four times more likely to graduate,” she said.

Don’t delay. While it’s never too late to start, the earlier you start, the better.

“For my kids, I started when they were just like under one year old,” she said. “And that’s really the key: Get the money in there as early as possible. Let it compound, let it grow.”

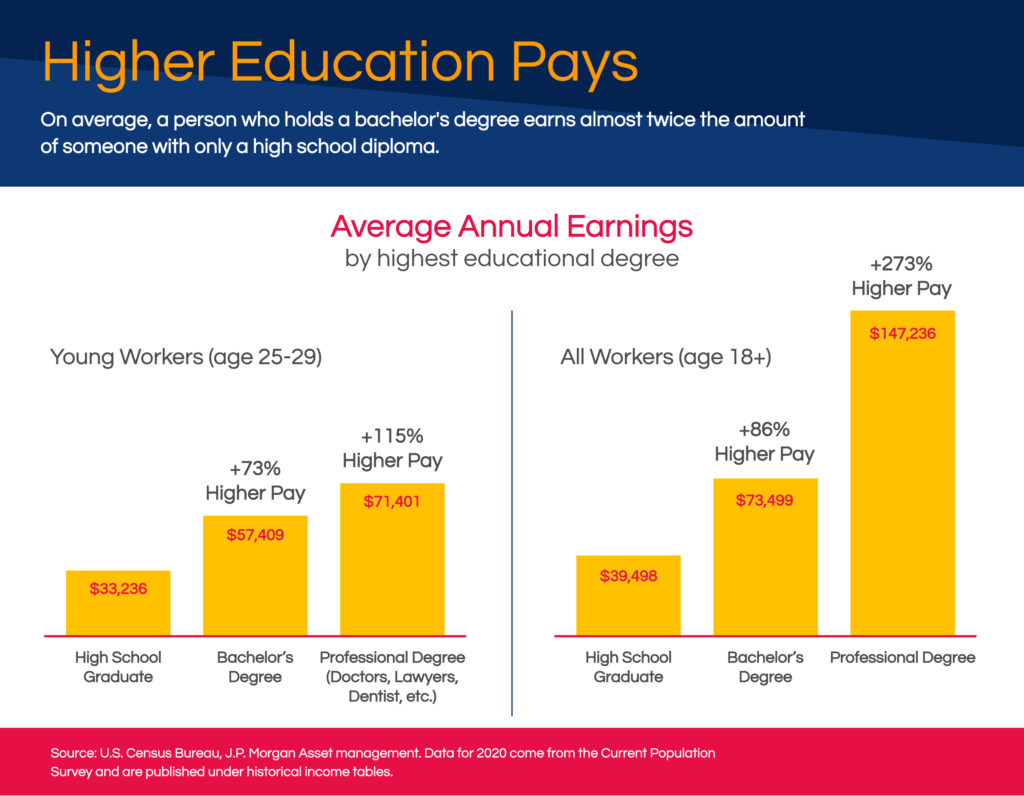

Not sure your newborn will want to go to college in 18 years? By giving them the option to complete college in an affordable way, you may be setting them up for lifelong financial success. According to data gathered by J.P. Morgan, a college diploma opens the door to higher earnings soon after graduation and throughout life, with the average high school graduate earning $39,498 annually and the average bachelor’s degree holder earning $73,499. College graduates also enjoy much better job security and opportunity, especially during economic downturns.

Tell friends and family about your accounts. “Bring grandparents more into the loop. Bring in more family members. Encourage people, if they’re making a birthday gift or graduation gift or something like that, to direct the gift toward the 529.”

See how Florida Prepaid makes it easy to give the gift of college.

Put in the right amount. “What I always say to clients is, first, you as the parent do not have to fund the entire amount. Some of it might come from financial aid, like grants. Some of it might come from loans, some of it might come from your savings.”

You may also need to manage your child’s expectations. Talk to them early about how much you will be able to fund each year, and that they will be responsible for the rest.

Automate your savings. “I do have clients who will say, ‘Well, we’ll sit down a couple times every year and decide what we can put in, and we’ll write a check.’ And really, that’s not the best way to do it,” Adam said. “Do monthly contributions if you can, even if they’re very small. It’s important to get it on autopilot. Get it set up, so whether you remember or you don’t remember, or it’s a good year or a bad year, you stay on track.”

“Most parents do not fund the whole thing, so don’t feel like you have to.”

Have questions? We’ve got answers! Explore our Frequently Asked Questions to learn more about our Prepaid Plans and Savings Plan. And click here to start your savings now!